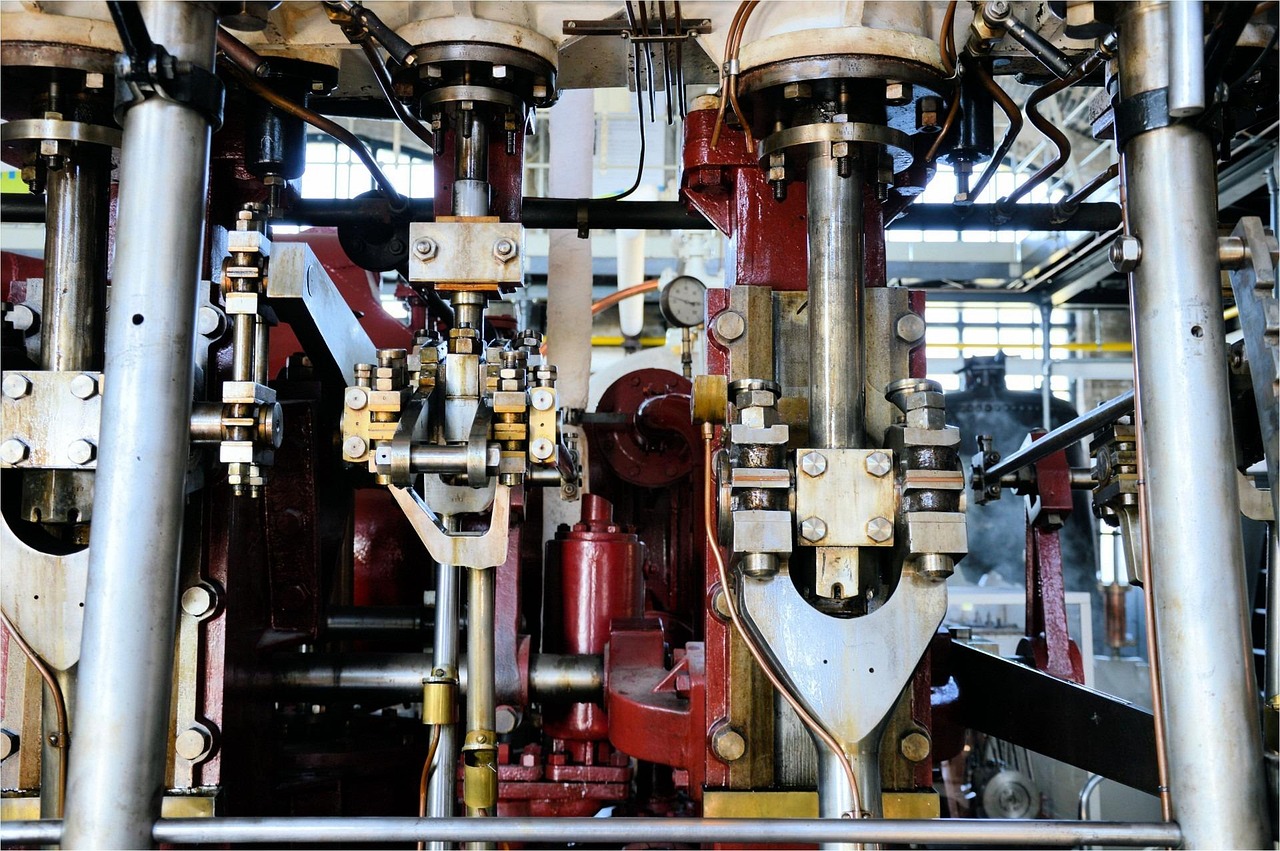

Machinery finance is a specialised form of asset finance designed to support businesses in acquiring the heavy equipment and machinery essential to their operations. Rather than requiring a large upfront capital outlay, this financing solution enables companies to spread the cost over manageable instalments, preserving cash flow and improving budgeting. Whether upgrading existing equipment or investing in new machinery to expand capabilities, machinery finance provides the flexibility and financial structure needed to stay competitive, enhance productivity, and scale operations efficiently.

Key Types of Machinery Finance

Benefits of Machinery Finance

- Preserve Cash Flow: Machinery finance allows businesses to acquire necessary equipment without tying up large amounts of capital.

- Tax Efficiency: Depending on the type of finance, businesses may benefit from tax deductions on interest payments, depreciation, or lease payments.

- Flexible Terms: Many finance options offer flexible repayment schedules tailored to the business’s cash flow and financial situation.

- Up-to-Date Equipment: Leasing options allow businesses to upgrade machinery regularly, ensuring they have access to the latest technology.

Considerations

When choosing machinery finance, businesses should consider factors such as interest rates, repayment terms, the total cost of ownership, and the potential for tax benefits. It’s also important to assess the long-term needs of the business to choose the right financing structure.

Machinery finance in Australia provides businesses with the flexibility to acquire essential equipment while managing cash flow effectively. With various financing options available, businesses can select the most suitable structure to support their growth and operational needs. For detailed advice and tailored solutions, it’s advisable to consult with financial institutions or a financial advisor.

Types of Machinery Equipment

- Wheel balancers

- Tyre changers

- Wheel aligners

- Vehicle hoists (2-post, 4-post, scissor lifts)

- ADAS calibration equipment

- Diagnostic scan tools

- Hydraulic jacks (industrial grade)

- Spray booths

- Excavators

- Skid steer loaders

- Bobcats

- Backhoes

- Forklifts

- Scissor lifts / boom lifts

- Compact track loaders

- CNC machines

- Laser cutters

- Press brakes

- Metal lathes

- Milling machines

- Welders (industrial, not portable hand-held)

- Pipe threading and bending machines (electric or hydraulic)

- Tractors

- Harvesters

- Seeders / planters

- Sprayers

- Slashers

- Industrial sweepers

- Floor scrubbers

- Truck-mounted carpet cleaners

- Hydro jetters / drain jetting machines (trailer or skid mounted)

- Large site water pumps (trailer mounted)

- Commercial printers / print finishing systems

- Large format plotters

- Server systems (enterprise level)