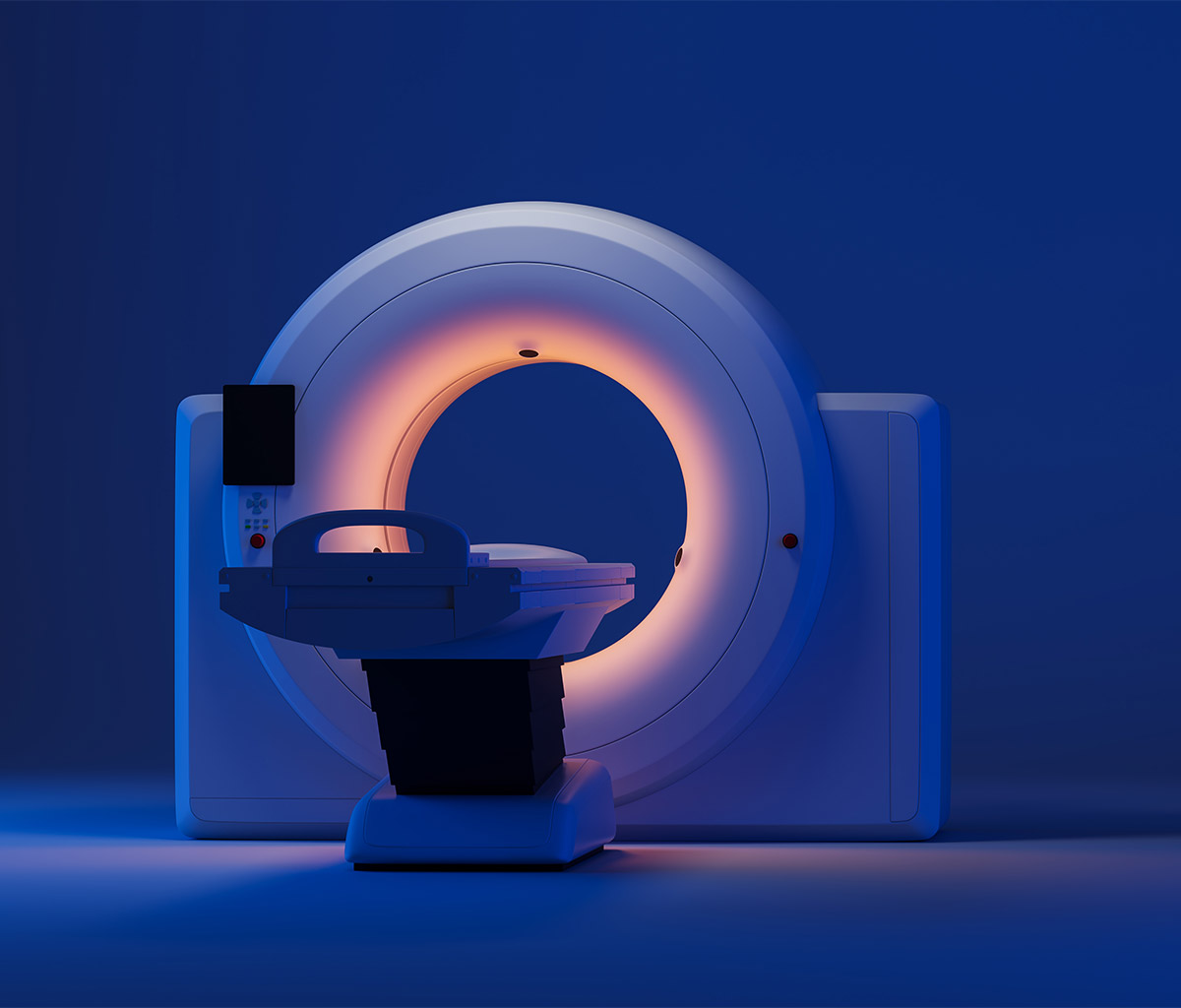

Healthcare equipment finance involves providing financial solutions to the healthcare industry to acquire, finance, upgrade, or lease medical equipment. Given the high cost and rapid technological advancement of medical equipment, financing is crucial for healthcare facilities like hospitals, clinics, and private practices to maintain and improve their services without the burden of large upfront investments. Healthcare equipment finance is essential for medical facilities looking to invest in new technology, upgrade existing equipment, or expand their services, all while managing cash flow and minimizing upfront costs

Key types of Healthcare finance

Considerations When Choosing Healthcare Equipment Financing

- Interest Rates and Terms: Compare different financing options to secure the best interest rates and terms that align with the facility’s financial goals.

- Technology Obsolescence: Consider the rapid pace of technological advancement in healthcare and whether leasing or renting might better accommodate the need for frequent upgrades.

- Cash Flow Management: Choose a financing option that aligns with the facility’s cash flow, ensuring the ability to make payments without disrupting operations.

- Tax Implications: Different financing structures may offer various tax benefits, such as deductions for lease payments or depreciation on purchased equipment.

- Regulatory Compliance: Ensure that the financing option chosen aligns with healthcare regulations and standards, particularly regarding patient safety and data security.

- Maintenance and Servicing: Consider who will be responsible for maintaining and servicing the equipment, as this can impact overall costs and downtime.

Benefits of Healthcare Equipment Finance

- Capital Preservation: Financing helps healthcare providers maintain cash reserves for other critical operational needs, such as staffing or facility upgrades, by spreading the cost of equipment over time.

- Access to Advanced Technology: Financing enables healthcare facilities to acquire the latest medical equipment, improving patient care and treatment outcomes.

- Flexible Terms: Various financing structures can be tailored to meet the specific needs of healthcare providers, whether for short-term rental, long-term ownership, or something in between.

- Scalability: Financing options allow healthcare providers to expand their services by acquiring additional equipment as needed, supporting growth and patient demand.

- Improved Patient Care: By ensuring access to the latest medical technology, financing can enhance the quality of care provided, leading to better patient outcomes and satisfaction.

Healthcare equipment finance is essential for medical facilities looking to invest in new technology, upgrade existing equipment, or expand their services, all while managing cash flow and minimizing upfront costs.

List of equipment

- Ultrasound machines

- X-ray systems

- ECG/EKG machines

- Blood analysers

- Autoclaves

- Centrifuges

- Anaesthesia machines

- Dental chairs

- Digital X-ray/Imaging systems

- Intraoral scanners

- Medical-grade computers & tablets

- Practice management software

- Telehealth systems

- Sterilisation units

- Air purifiers