Engraving machine finance offers tailored financial solutions for businesses seeking to acquire, lease, or upgrade engraving technology. This type of financing supports industries that rely on precision and customisation, enabling them to access modern equipment without the burden of large upfront costs. By spreading expenses over time, businesses can maintain healthy cash flow while investing in tools that enhance efficiency, quality, and production capacity.

Key Types of Engraving Machines Financing

Rental / Operating Lease

The business sources the equipment and then the lessor purchases it. The lessee pays a rental fee and at the end of the lease term, the business can purchase the equipment, return the machine, renew the lease, or upgrade to newer equipment.

Finance Lease

The Finance Company purchases the goods on behalf of the business who then makes repayments. The lessee has the option to purchase the equipment at the end of the lease term for the Residual Value.

Chattel Mortgage

In a hire purchase agreement, the business makes an initial down payment and then pays off the equipment in installments. Ownership transfers to the business after the final payment. This is suitable for companies that prefer to own the engraving machine eventually but want to spread the cost over time.

Vendor Financing

Some engraving machine manufacturers or suppliers offer financing options directly or through partnerships with Finance@work. These programs often feature competitive rates and terms tailored to the specific equipment being purchased.

Managed Services Program

Instead of purchasing, businesses can opt for a subscription-based model where they pay a recurring fee for access to engraving machines, software, and support services. This model helps avoid large upfront costs and ensures access to the latest technology.

Unsecured Loans

These loans do not require collateral but typically come with higher interest rates. They offer flexibility and can be used for various types of engraving equipment.

Considerations When Choosing Engraving Machines Financing

- Interest Rates and Terms: Evaluate different financing options to secure competitive interest rates and terms that align with your business goals.

- Technology Obsolescence: Consider the rapid pace of technological advancements in engraving and whether leasing or renting might better accommodate the need for frequent upgrades.

- Cash Flow Management: Choose a financing option that aligns with your cash flow, ensuring you can make payments without disrupting operations.

- Tax Implications: Understand the tax benefits or liabilities associated with different financing structures, such as potential deductions for lease payments or depreciation on owned equipment.

- Maintenance and Support: Factor in who will be responsible for maintaining the engraving machine, as this can impact overall costs and operational efficiency.

- Upgrade Flexibility: Consider how easily you can upgrade to newer models if your business needs change or technology advances.

Benefits of Engraving Machines Financing

- Capital Preservation: Financing helps businesses maintain cash reserves for other operational needs by spreading the cost of engraving machines over time.

- Access to Advanced Technology: Financing enables businesses to acquire the latest engraving technology, improving precision, efficiency, and production capabilities.

- Flexible Terms: Various financing structures can be tailored to meet the specific needs of different businesses, whether for short-term rental, long-term ownership, or something in between.

- Scalability: Financing options allow businesses to scale their operations by acquiring additional engraving machines as needed to meet growing demand.

- Risk Mitigation: Leasing or renting can reduce the risks associated with equipment depreciation and obsolescence, especially in industries where technology evolves rapidly.:

- Tax Advantages: Business can either claim the repayments or interest and depreciation as a deduction. Seek advice from your accountant or financial adviser.

Types of Engraving Machine Equipment

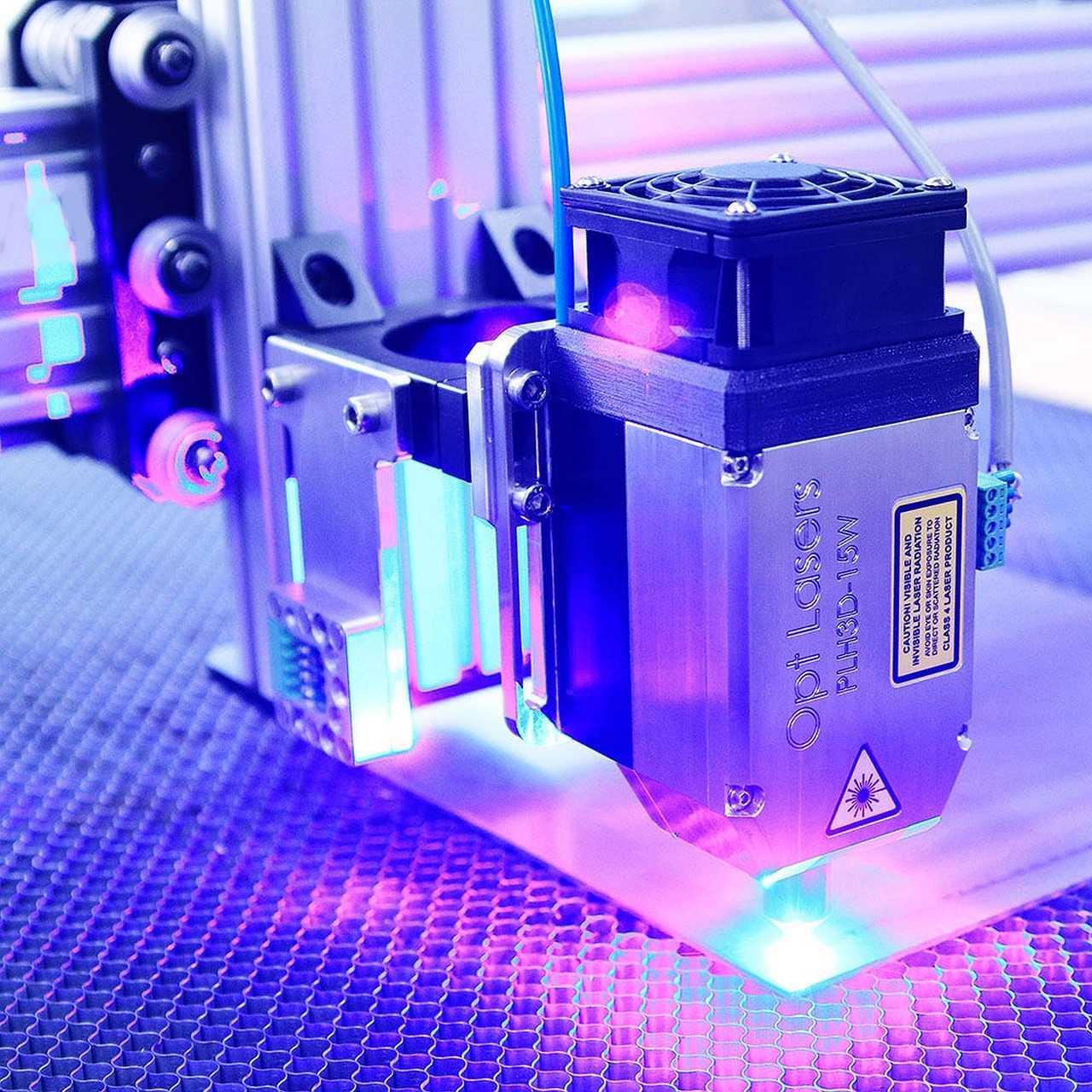

Laser Engraving Machines

- CO₂ Laser Engravers

- Fiber Laser Engravers

- Diode Laser Engravers

- UV Laser Engravers

Rotary & CNC Engraving Machines

- CNC Rotary Engravers

- High-Speed Spindle Engraving Machines

Marking & Etching Solutions

- Dot Peen Marking Machines

- Electrochemical Etching Systems

Engraving Accessories

- Rotary Tables & Workholding Jigs

- Air Assist & Fume Extraction Systems

- Cooling Units for Laser Machines

Software & Digital Tools

- Engraving Design Software (CAD/CAM)

- Laser Control Software (EZCAD, LightBurn)

- Graphic Software Integration (CorelDRAW, Illustrator)